4AIR’s Take: SAF’s Growth Story—the Facts Behind the Headlines

Recent coverage of the SAF industry has sparked renewed discussion around its scalability. While it’s true that only a dozen or so of the 150+ announced SAF projects have reached commercial production, it is easy for us to miss just how far we have come in just a few years. We could always be moving faster, but this progress is laying a strong foundation for future growth. The data reveals a story of rapid progress and expanding potential.

SAF is not a silver bullet, but it remains the most viable and most impactful near-term solution for decarbonizing aviation for the next few decades. Its compatibility with existing aircraft and infrastructure makes it uniquely positioned to reduce emissions across a global fleet that will still be flying in 2050. Scaling SAF is inherently complex, requiring rigorous certification, massive capital investment, and coordination across fragmented supply chains. These challenges are real, but they’re not signs of failure— they’re the realities of transforming a hard-to-decarbonize sector that has used petroleum-based fuels to power aircraft for over 100 years. Jet A and Jet A-1, or kerosene, is one of the most ideal energy carriers for aviation. If we can produce it from a sustainable source, it is a powerful decarbonization option.

SAF must be drop-in compatible and meet strict performance and safety standards, such as ASTM D7566, which ensures synthetic fuels can be blended and reclassified as Jet A. Each production pathway undergoes a multi-year certification process, and currently only 11 are approved by ICAO. But this process builds trust, ensures reliability, and enables safe scalability. These are not barriers to progress, but rather the necessary steps to ensure SAF can safely and effectively power the future of flight.

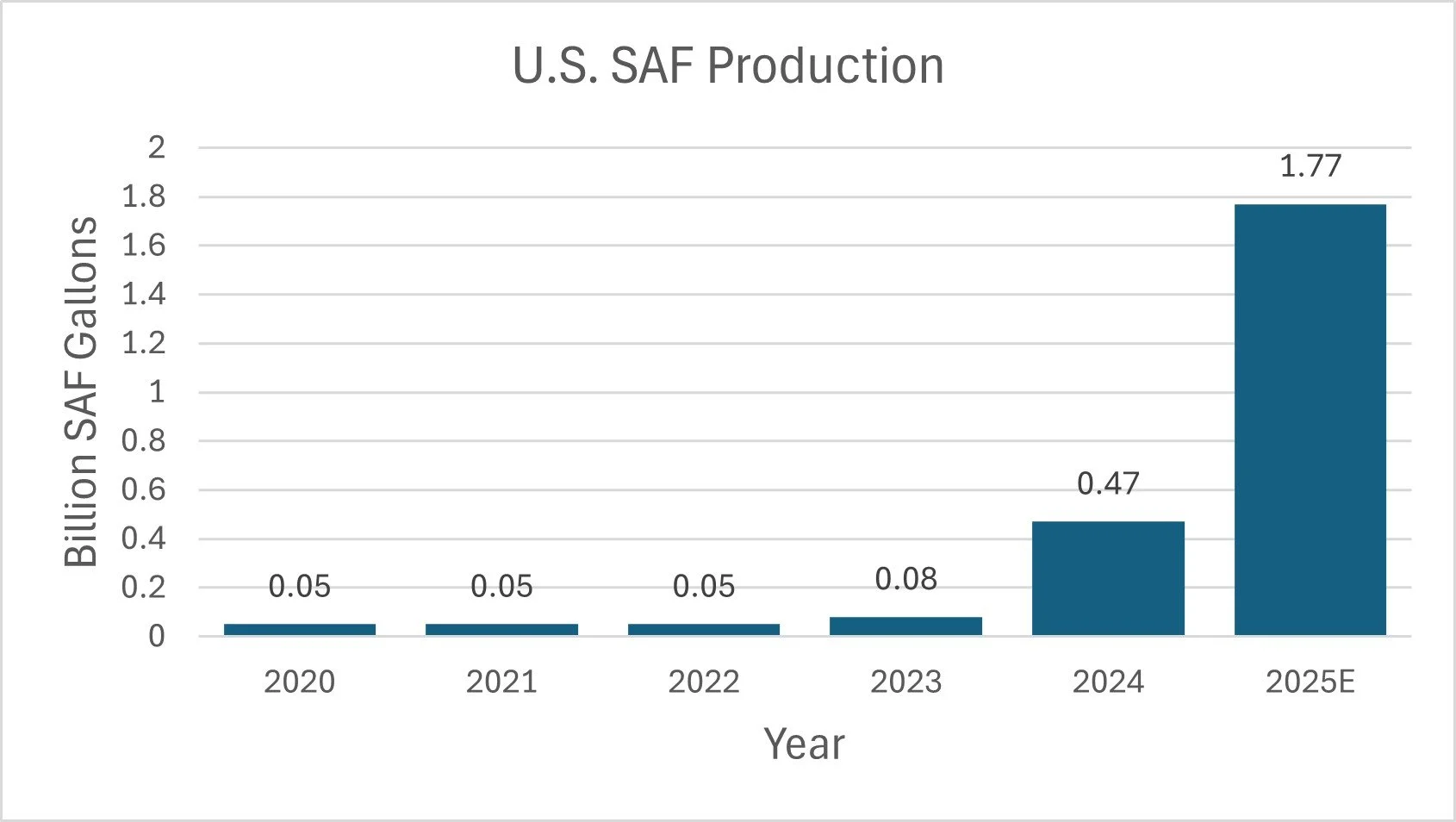

The data tells a more optimistic story. Since 2019, SAF volumes have grown exponentially. Globally, SAF production volumes reached 1 million tonnes (1.3 billion liters or more than 343 million gallons) in 2024. That is double the 0.5 million tonnes (600 million liters, 158 million gallons) produced in 2023. In the U.S., SAF supply grew from 2,000 barrels per day (b/d) to approximately 25,000 b/d in 2024. Today, SAF represents almost 1% of total jet fuel, a small amount, but 100x more than it did 4 years ago. The trajectory is clear: production is accelerating, and the industry is building momentum. Projections forecast between 2-3 billion gallons annually over the next 5 years — another 300-500% increase over 2024.

4AIR tracks the physical distribution availability of SAF for business aviation and, in 4 years, we have gone from 17 locations with SAF available to more than 110 as of May 2025.

Image: 4AIR Graph depicting exponential growth in U.S. SAF production. Sources: IATA, BCG, RMI, GreenAir News, Aaron Robinson

Business aviation plays a critical role in this transition. With its flexibility and capacity to invest early, the sector has long served as a proving ground for sustainability innovations, from winglets to blended-wing designs. Today, it’s helping scale SAF through forward-looking programs, partnerships, and advocacy.

The SAF story is far from over. While we’d always like to be further along, the progress made in just a few years is incredible and worth appreciating. It does not mean it’s time to let up either, we need to continue investing in SAF, supporting innovation, and shaping smart policy, so that aviation can continue advancing toward a more resilient and sustainable future.

Further reading and more good news on SAF here:

DOE funds 2 SAF research projects | Biomass Magazine (September 2025)