Navigating Carbon Offsets: How to tell good offsets from bad offsets

Encountering the carbon offset market can lead to a lot of confusion around whether offsets are actually effective or legitimate. When engaging the carbon markets, it is vital to understand how to distinguish a true verified carbon offset from similarly named products that might appear to be the same thing. Even within verified carbon offsets, there can be additional levels of quality that are important to navigate.

To start, let’s understand a history of offsets

Offsets were originated as a “flexibility mechanism” under the Kyoto Protocol in 1998 as countries were anticipated to launch large scale climate commitments.

The first type of offset was known as the clean development mechanism (CDM) and was launched as a way for international offsets to be made between countries. It was a verifiable carbon credit that represented the reduction of one metric ton of CO2 from a certain project and that followed certain methodologies.

With the financial crash of 2008, demand for CDM credits tanked. It wasn’t until the reemergence of corporate climate commitments in the late 2010s and the launch of new voluntary methodologies – such as ones well established today like Verra and Gold Standard – that the market would begin to take off.

How does a credit get verified?

A new carbon offset project goes through two verifications. First the project has to be verified to meet a particular methodology from the issuing registry (see Verra’s methodologies for an example). Specific guidance must be followed around the design of the project, legal safeguards, crediting period, and planned monitoring procedures that are all dependent on the type of project. There are five main qualities being looked at during the verification process:

“The registry publicly documents all of the registration and verification information related to each credit and the unique serial numbers trace the ownership and verification down to the metric ton level.”

Permanence – that the emission reduction will not be reversed.

Additionality – that the reduction would not have happened anyway under a “business as usual” scenario.

Verifiability – that the emission reduction can be independently verified and validated by a third party.

Enforceable – that the emission reduction can be quantified following a consistent methodology and backed up by enforceable contracts.

Real – that the emission reduction occurred and can be tracked and exclusively claimed with a unique serial number.

Second, after the launch of the project, once the “crediting period” has begun, annual or biannual audits are commenced before any credits can be issued by the registry. Once the third-party environmental auditor ensures that the project has mitigated the emissions, each metric ton is assigned a unique serial identification number that can trace that specific reduction. These credits are then issued to the public registry and can be transferred and retired. The registry publicly documents all of the registration and verification information related to each credit and the unique serial numbers trace the ownership and verification down to the metric ton level.

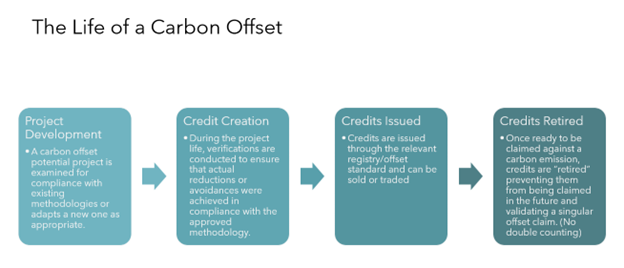

This intricate credit generation process confirms that the project followed its planned methodology and that real, estimable, and verifiable reductions occurred. See below for a summary of the process a carbon offset goes through:

Verified vs unverified; forwards

These verified credits represent something different than other similarly named offset projects. Other companies may sell what seem like a carbon offset, but the accounting for the reductions don’t go through the same independent audit or meet the same typical requirements that a verified credit does, nor are they as robust. The biggest concern is that these types of unverified carbon mechanisms may lack additionality – the concept that this emission reduction would not have occurred otherwise – and without external verification, it is hard to prove an additionality claim.

A similar unverified product is something called a forward, as this represents buying an emission reduction that has not occurred yet – which is different than a forward contract to buy an existing carbon credit in the future. While a strong case for additionality in this case exists, there are risks whether the reduction will be realized, permanent, or verifiable.

In order to buy an emission reduction that has been realized and independently verified, it is critical to buy a verified carbon offset.

Let’s dive into some of the nuances around two popular types of verified projects: forestry and renewable energy.

A deeper dive into forestry

There are a few types of forestry credits:

Afforestation – the creation of a new forest;

Reforestation – the replanting of a previous destroyed forest; and

Avoided deforestation – the mitigation or prevention of a planned or likely destruction of a forest.

Afforestation and reforestation are relatively easy to understand how they reduce emissions, as all of the trees are new and the new growth sequesters carbon in the tree trunks and soil.

Avoided deforestation requires a closer look. To understand the need for this type of project, it is critical to appreciate that deforestation is one of the leading causes of global emissions, producing over 20% of global emissions. For Indonesia and Brazil – the third and fourth most polluting countries – deforestation contributes up to 80% of their annual emissions (Measuring Carbon Emissions from Tropical Deforestation: An Overview).

“Deforestation is one of the leading causes of global emissions, producing over 20% of global emissions. For Indonesia and Brazil – the third and fourth most polluting countries – deforestation contributes up to 80% of their annual emissions.”

Protecting a forest can be seen as a feel-good project, but they are a major way to slow down global emissions in the short term. However, because we are preventing something from happening (cutting down existing trees), instead of causing something new (planting new trees), the credits can be subject to additional scrutiny, usually because of a lack of understanding around the accounting for emissions reductions. Deforestation, like other forestry projects, have two safeguards built in to help protect the emission reductions claimed from the project: leakage and buffer pools.

Leakage is the idea that while a forest in one location might be protected from deforestation, land elsewhere may be deforested instead. Obviously if the deforestation just shifts to a new location, a forestry project wouldn’t have reduced any emissions. Most projects use a standard leakage rate of 40% - this means they are assuming that while 10 trees might be saved within the project, 4 are likely to still be cut down elsewhere. Importantly, this means that for every 10mt of carbon saved, only 6mt can be issued to net out the effect of leakage.

If a lower leakage rate than 40% can be proven, a project may use that but must take on additional monitoring requirements.

Buffer pools are similar to a built-in insurance policy. Many projects have to accrue a certain number of their annually issued credits into a buffer pool account. These untradeable, reserved buffer credits come from a wide variety of usually non-forestry projects to help insulate the risk of loss. Any Agriculture, Forestry and Other Land Use (AFOLU) project (including the forestry projects above) is covered under this buffer pool approach.

If any carbon offset is lost in an individual project from unforeseen events such as fire or disease, buffer credits may be retired from the buffer pool to compensate the original offset owner. Thus, the buffer pool is still able to provide the offset owner with their metric ton reduction claim even in the event of a fire or other forest loss.

Forestry credits can be more complicated than a typical project, but they are quite necessary in the fight against major emissions from deforestation. These built-in leakage and buffer pool safeguards are one more reason to use verified and reputable registries.

Additionality in renewable energy projects

Renewable energy is another very popular carbon offset type and again an important one due to the amount of emissions that come from electricity generation. 25% of US emissions come from generating electricity and about two-thirds of global energy-related (non-land use change or deforestation) emissions come from electricity production.

“25% of US emissions come from generating electricity and about two-thirds of global energy-related (non-land use change or deforestation) emissions come from electricity production”

As the world broadly converts from fossil fuel electricity generation to renewables, the cost of new renewable energy installation has been decreasing and has come into price parity in many countries. When this occurs, this financial incentive means that new renewable energy installation is likely to be the new “business as usual” and will be installed even without the assistance of carbon offset financing. This new phenomenon has been helped by historic renewable energy-based carbon offset projects as it has accelerated the production and installation economies of scale of new wind and solar facilities.

As we achieve price parity in many countries, we are encountering a turning point where carbon offsets are no longer needed and cannot be issued for new projects as the new projects would likely not meet additionality requirements.

That said, even if renewable energy installation is a likely inevitable occurrence, a project may still be additional for accelerating the installation of new capacity that displaces fossil fuel, particular in LDCs (Least Developed Countries). Local conditions can still be conducive for the quicker retirement of fossil powered plants and conversion to renewable sources through carbon offsets. From 2020 on, Verra and Gold Standard will only approve small scale or renewable energy projects in LDCs.

Overall, we are likely to see a decrease in renewable based carbon offset projects moving forward. Renewable energy can be seen as one of the success stories of the carbon market, as it helped accelerate a technology to achieve price parity with its fossil fuel counterpart.

So what does that mean for the future of offsets? What will the next type of offsets look like?

Avoidance vs Sequestration

Before getting started on the future of offsets, it is good to define some ways carbon offsets can actually reduce carbon. Most projects today deal with the avoidance or reduction of carbon – planting or saving a tree sequesters carbon in a short-term cycle within the mass of the tree; renewable energy displaces electricity and avoids emissions from fossil-fueled power plants; production efficiencies also reduce or avoid incremental emissions. So, carbon offset projects today are focused on avoiding emissions that would have happened or sequestering emissions in a short-term cycle.

In contrast, the goal of future sequestration offsets is to remove carbon already in the atmosphere and sequester into a long-term cycle. Direct air capture (“mechanical sequestration”) aims to pull out carbon from the atmosphere through large fans and store it underground, typically in salt caverns or old oil wells. In contrast, “natural sequestration” looks at leveraging natural processes to accelerate longer term sequestration of atmospheric carbon.

Natural sequestration is very interesting because while still 10-20 times the price of current offsets costs, they are 2-10 times cheaper than any mechanical sequestration and still offer longer-term sequestration of existing carbon, not just short term nor avoidance.

The next phase of carbon offsets

Let’s look at two examples of natural sequestration:

Kelp (Macroalgae) Sequestration – growing kelp stores carbon in the biomass of the plant, similar to a tree trunk on land. Once fully grown, the kelp is sunk into the deep ocean where the carbon within the biomass gets sequestered into the sediment as the biomass is eaten or decomposed. This is a natural process that is accelerated through the growth of additional kelp (and closely monitored for accurate emissions reporting).

Mineralization/Weathering – a few natural minerals, namely a green volcanic rock called olivine, sequester carbon as they weather and erode. As sea water interacts with the olivine, the mineral erodes into calcium carbonate (a mineral used in seashells) and sequesters atmospheric carbon in this mineralized form. This is also a natural process that is accelerated by adding olivine to new places and increasing the amount of CO2 sequestered.

Both of these projects are representative of some of the next generation of offsets, where longer-term and more robust sequestration-type offsets can be purchased. However, it is important to note that none of these or similar methodologies are currently verifiable under an independent registry. Registries are developing new methodologies for these types of projects, but none have been issued yet.

5 Questions you should ask your offset provider:

Understanding the background on offsets now, what are some key questions to ask when purchasing an offset?

What standard was the offset project verified to?

Ensure that the project meets the stringent requirements of a third part offset standard/methodology. Ask for a link to the online public listing so you can inspect the specific project being offered as well as its registration documents.

Is that verification standard a CORSIA approved registry?

Verra, Gold Standard, ACR and CAR are examples of CORSIA approved registries. Make sure that the verification standard being used is reputable. ICAO performed an extensive vetting process to review independent registries and it is recommended to only purchased credits from one of these reputable standards. A full list can be found here.

Is the project CORSIA eligible?

Depending on your regulatory requirements, you may or may not need a CORSIA eligible project, which imposes additional restrictions on the project type and vintage depending on the verification standard used (a CORSIA approved standard is not the same thing as a CORSIA approved credit).

What is the crediting period for the project?

In addition to knowing the vintage (the year that the emission reduction occurred), it can be good to know the crediting period, or the length of time that the project can generate credits. Most projects are limited to 10 years by verification standards, so longer or indefinite answers may arouse suspicion about the project.

Are there any cobenefits of the offsets?

Most offset projects carry additional environmental and social benefits, typically sets of the UN Sustainable Development Goals, but other third party verifications or accreditations may provide additional legitimacy to a project.

Where do offsets fit in?

So, where do offsets fit into a corporate strategy? The important realization is that an offset is not designed to be the end goal. Offsets are a mechanism for aligning financing across industries with the lowest hanging fruit for global decarbonization. As the easier and cheaper reductions are realized, more expensive projects and reductions are unlocked.

For a corporation, offsets represent the opportunity to be carbon neutral today, while the organization is in the process of reducing emissions. This is particularly relevant for aviation, where few options are accessible for decarbonization today. Offsets allow aviation to be carbon neutral and work towards additional reductions through SAF or new technology.

Offsets can be the right first step on a sustainability journey. Many partners and corporations start with offsetting, and then work towards reducing or larger projects. Offsetting puts a price on carbon within the organization that is used to motivate and assess where reduction efforts should be focused.

Offsets should not be considered the end-all, be-all solution for your sustainability program. When working towards your goals, with a partner such as 4AIR, they should be seen as an effective first step in your commitment to a meaningful long-term sustainability program.